According to the report of markets and markets, it is predicted that the global kaolin market will grow from US $4.56 billion in 2017 to US $5.7 billion in 2022, with a compound annual growth rate of 4.6%.

Calcined kaolin is increasingly used by industries such as coatings, paper, glass fiber and rubber, and is expected to grow at the highest CAGR (in value) over the forecast period.

According to the end use industry, the paper sector and the kaolin market value for coatings will lead the Kaolin Market during the forecast period. Kaolin can be used as filler in papermaking production to improve various other properties of paper. As pigment and filler of coating, kaolin has ink absorption and ink pigment inhibition, which in turn enhances the printability of paper.

The Asia Pacific region is the largest Kaolin Market in the world. In terms of value, the Kaolin Market in the Asia Pacific region is expected to grow at the highest compound growth rate in the forecast period.

1. Distribution of global kaolin reserves and production

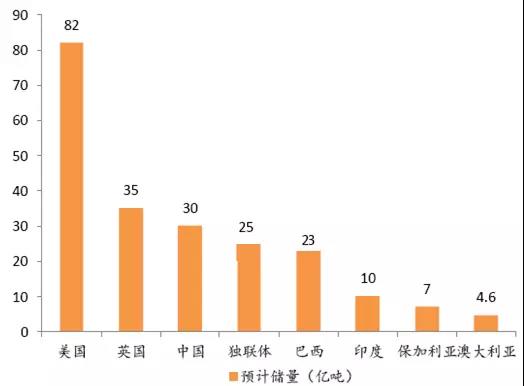

(1) distribution of global kaolin reserves:

at present, the proven reserves of kaolin in the world are about 32 billion tons, mainly distributed in the United States, Britain, China, Brazil and other places, among which the reserves of 8.2 billion tons are the first in the United States, and the reserves of 3 billion tons in China, ranking the third in the world.

Global kaolin resource distribution

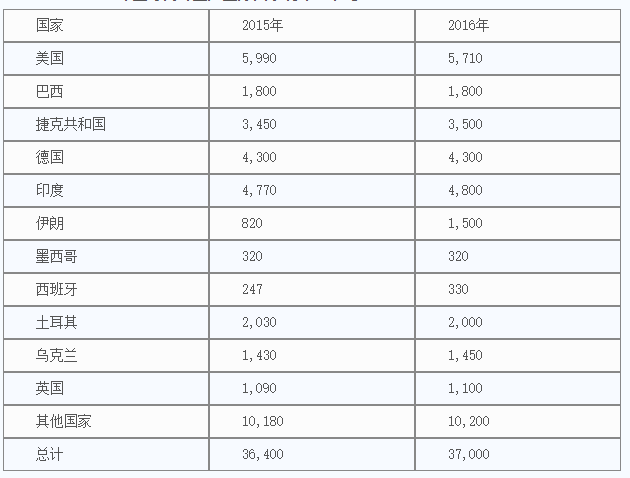

(2) global kaolin production distribution:

According to the "minimum commodity summaries 2017" issued by the US National Geological Service in 2017, the global kaolin production reached 37 million tons in 2016, an increase of 1.65% over the same period of last year.

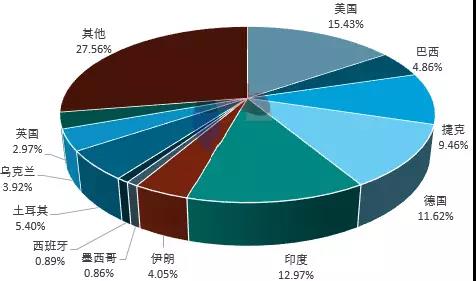

Uzbekistan, Germany, the United States, the Czech Republic, Brazil and other countries are the most important kaolin producing areas in the world. In 2016, the United States ranked first in the world with an annual output of 5.71 million tons, accounting for 15.4% of the world.

Global kaolin production statistics by country from 2014 to 2015 (thousand tons)

Regional distribution pattern of global kaolin production in 2016

(3) Main kaolin producer in the world:

imeries company: French company. In early 1999, imeries group offered 756 million pounds to acquire ECC company, the world's largest kaolin producer, becoming a giant in the world's kaolin industry. Now the annual output of kaolin is close to 7 million tons.

Engelhard company: an American company, founded in 1902, with an annual output of 2 million tons of kaolin. In recent years, calcined kaolin and high-grade paper kaolin have been developed. The special kaolin is mainly used in plastics, rubber, ink, cosmetics, ceramics, binders, coatings and other industries.

Huber company: American company, founded in 1883, kaolin, one of the leading products, has been widely used in coating pigments of the world's paper industry, with an annual output of more than 2 million tons. Mainly engaged in four types of products: hydrated kaolin, calcined kaolin, ultrafine kaolin and chemically modified kaolin.

Thiele company: an American company with an annual output of 1 million tons. It plans to expand the production to 1.5 million tons. It is in the leading position in processing kaolin pigment, and 1 / 3 of its products are sold to Canada, Europe and the Pacific region. The main products are calcined kaolin, kaolin coating, high brightness kaolin coating, standard brightness kaolin coating, kaolin filler and so on.

Cadam company: the largest kaolin producer in Brazil, the leading enterprise of kaolin for paper coating in Brazil. Its kaolin reserves exceed 2.504 billion tons, its quality is excellent, and its natural whiteness is 86.3% ~ 89.3%. According to the current production of kaolin, cadam can provide 350 years of kaolin demand in the world, and 90% of its products are exported to Europe, Asia and South America.

RCC company: the second largest kaolin company in Brazil, is the leading enterprise in producing kaolin for paper coating in Brazil. Originally controlled by dbk (drying company) in the United States, now controlled by imeries (99% equity) in France. The processing technology includes cyclone classification, magnetic separation and bleaching.

PPSA: the third largest kaolin company in Brazil, is a joint venture, 36% owned by cadam, and 18% owned by Mitsubishi. PPSA's mine is located on the kapin river near ipixuna in Parra state. It started kaolin production in 1996 and sold more than 510000 tons in 2004.

2. China's kaolin production and demand distribution

(1) China's kaolin production and supply and demand situation:

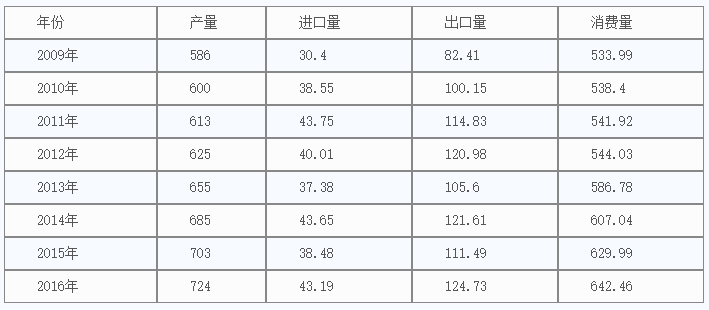

in recent years, China's kaolin production has developed rapidly. In 2016, China's kaolin development output is about 7.24 million tons, and the market coverage has developed from a single ceramic and paper industry to dozens of industries.

in China, soft kaolin is mainly concentrated in Suzhou, Jiangsu, Maoming, Zhanjiang, Guangdong and Longyan, Fujian, while hard calcined kaolin is mainly concentrated in Shanxi and Inner Mongolia.

2009-2016 supply and demand balance of China's kaolin industry (10000 tons)

(2) Market demand analysis of kaolin in China

Ceramic industry: according to the "13th five year plan" development guidance of building ceramics and sanitary ware industry issued by China Building and Sanitary Ceramics Association, by 2020, China's building ceramics market demand will be 9 billion m2, bathroom ceramics demand will be about 250 million pieces, and daily ceramics demand will be about 30 billion pieces.

According to relevant statistics, the consumption of kaolin in China's ceramic industry was about 1.1 million tons in 2005 and 1.4 million tons in 2010. Combined with the above prediction results of China's ceramic output, it is predicted that by 2020, the demand of kaolin in China's ceramic industry will reach about 3 million tons, including about 600000 tons of high-grade ceramic raw materials.

Paper industry: Kaolin is mainly used as filler and coating in paper industry. In 2015, the consumption of kaolin in the domestic paper industry was about 1.65 million tons. According to the historical data and the development trend of the future output of the paper industry, it is predicted that by 2020, the demand of kaolin in the national paper industry will be about 2.55 million tons, of which the domestic output will account for about 65%.

Refractories industry: according to the statistics of China refractories industry association, in 2015, the output of refractories in China was 26.1519 million tons, a year-on-year decrease of 6.51%; the consumption of kaolin was 126000 tons, a year-on-year decrease of 5.31%. At present, the refractory industry is facing the dual pressure of overcapacity and market demand slowing down. It is expected that the future output will still have a certain decline space, and then tend to be stable. According to the prediction of industry experts, by 2020, China's refractory output will be about 25 million tons, and the corresponding kaolin demand will be about 124000 tons.

Paint and coating industry: Kaolin is mainly used as filling framework in paint and coating production. At the same time, due to its excellent dispersion, stable chemical properties, corrosion resistance and fire resistance, kaolin can be used as additive in coating production to improve the adsorption capacity and covering capacity of coatings. In addition, titanium dioxide is the raw material for coating production, which is more expensive. Kaolin can partly replace the product, thus greatly reducing the production cost of coating.

According to the 13th five year development plan of China's coatings industry, the total output of coatings in China will reach 22 million tons in 2020, and the demand for kaolin processing products is expected to be about 650000 tons.

(3) Overall demand analysis:

from the forecast results, the application demand of kaolin processing industry presents the following characteristics:

(1) The downstream application fields and application scope are expanding, and the total demand for kaolin processing products is growing.

(2) the coating industry, especially high-end coatings, will gradually replace refractories and become the third largest kaolin consumption industry in addition to ceramics and paper industry. By 2020, the proportion of kaolin consumption in the coating industry will reach about 10%.

(3) with the transformation and upgrading of the national economy and the impact of the overall industry overcapacity, the demand of refractory for kaolin is currently in the saturation period, which will slow down and maintain at about 120000 tons by 2020.

(4) the demand of other industries for kaolin high-end processing products will continue to grow, mainly including cutting-edge materials science, special industrial ceramics, national defense and military industry, pesticides, petrochemicals, cosmetics, etc.

Ceramics, papermaking and coatings will still be the main consumer industries of kaolin in the future for a long time, especially new ceramics, high-end papermaking and advanced coatings, which have higher and higher requirements on the processing quality and quality of kaolin. In addition, the demand of other industries such as national defense and military industry, special materials and other fields is also gradually increasing.

Therefore, China should aim at the development of high-end kaolin processing industry, upgrade the processing technology and equipment level, enhance the competitiveness of the industry, and gradually gain the corresponding position in the global Kaolin Market.